ERP Evolution

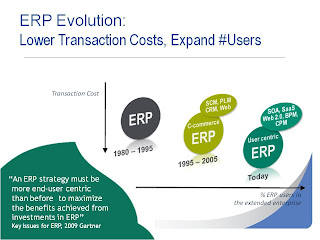

Back in the 80’s, ERP software have been created in order to address a key productivity issue in the enterprise. The goal, as it is still the case today, was to reduce transaction costs in automating key business processes from manufacturing through finance and sales organizations.

Transaction Cost

The notion of transaction cost was introduced back in the 30’s by a brilliant British economist by the name of Ronald Coase in his essay The Nature of the Firm in 1937 to explain why the economy is populated by a number of business firms, instead of consisting exclusively of a multitude of independent, self-employed people who contract with one another. It is an even more interesting approach knowing that this research occurred just after the big depression period, to be remembered as we have been going through an impressive downturn just now.

A transaction cost can be defined as a cost incurred in making an economic exchange. For example, most people, when buying or selling a stock, must pay a commission to their broker; that commission is a transaction cost of doing the stock deal.

Or consider the evolution of transacting with your bank. Back a few decades ago, you would have to go to the branch office for any operations like deposit a check, getting cash… This induced for the bank to maintain branch offices and full-time employees managing these interactions. The cost of every transaction with its customers was in the $10 range average. Over time, the banking industry leveraged telephone based interactions, ATMs and of course internet banking to take that transaction cost significantly down, let’s say a few cents. At the same time, customer satisfaction went up as the transaction can take place at any time 24/7, from anywhere and customers are driving the transaction themselves.

ERP Evolution of the 90’s

As the success of ERPs went on and businesses understood the value of automating key business processes with “off-the-shelf” enterprise application software instead of writing one from scratch, their appetite for more automation, more users involved and lower transaction costs, increased.

The advent of the web and its ability to connect totally different IT systems seamlessly over the cloud, with e-mail to start with then web services, offered an opportunity to ERP vendors to expand the ERP scope to other part of the organization such as sales force automation (CRM), supply chain operations (SCM, SRM) and product life cycle management (PLM). It also did pave the way to connect remote users to the ERP via thin clients or ERP client in a browser to be more precise.

This was the second generation ERP, in which a lot of ERP vendors are still in, allowing for users of the extended enterprise (suppliers, resellers, customers…) to participate in key business processes thus lowering even further transaction costs.

3rd Generation ERP

As a result, all of the ERP vendors did a pretty good job to automate all transactional business processes such as order-to-cash, service fulfillment and supply chain execution.

As a matter of fact, employees are now focusing on managing exceptions and pursuing business opportunities which are highly collaborative or information driven activities, devoting minimal time to transactional business processes. This is good for the enterprise and ERPs are thriving on this.

The net result is that the appetite to lower transaction costs is increasing again but this time, to automate more business processes, ERPs must take into account:

- Collaborative technologies: web 2.0 technologies to start with, but dashboarding (EIS) and alerts management as well,

- Information driven decision making technologies: business intelligence (BI) and performance management (CPM, EPM…),

- Visual processes representation and automation: business process management (BPM) and adaptive workflows

- Enterprise Application Interaction and Integration over the web: Service Oriented Architecture (SOA), Cloud Computing and Software as a Service (SaaS)

- Mobility: mobile client computing, smartphones and tablet devices interactions

Digital natives are to rule the business

Digital Natives or Generation Y, referring to individuals born between the mid 70’s and early 90’s, will outnumber baby boomers in the enterprise in 2010.

96% of them already joined a social network online and they will be the managers of our businesses within the next 10 years. They are all about these new technologies to conduct both their personal life as well as their professional one, which reinforces the need to accommodate them when we think about ERPs and more generally the new generation of enterprise applications.

User centric ERP

As we combine the appetite to lower transaction cost, encompassing collaborative business processes, as well as re-engage with all users of the extended enterprise and accept that individuals are more educated and better equipped at home than in the office when it gets down to information technologies, ERPs need to reinvent itself one more time.

ERPs must be thought from the user out, it must be user-centric and re-engage with all stakeholders in the enterprise or it will become legacy. Modernizing ERPs towards 3rd generation ERPs, as described earlier, is a must to reach new levels of productivity, agility and effectiveness in the extended enterprise.

The recent evolution of our globalized and highly competitive economy, the acceleration of change and the ubiquity of information will allow for no choice but for enterprises to embrace these new trends or disappear.

"Between the dawn of civilization and 2003 there were 5 exabytes of information created, same as in the last 2 days." -- Eric Schmid, Google CEO

Now is a good time to replace legacy business management software, as most companies did that move back 7 to 10 years ago with Y2K, the Euro introduction or US GAAP, IFRS or Sarbane Oxley regulations.

Emerging economies should take advantage of their relative low technology adoption to leap frog this information era revolution and appear as highly competitive businesses. The wired economy we’re living in now is a massive opportunity.

1 comment:

Nice blog post thanks for sharing it.

Cloud Billing Software

Post a Comment